Last week, the UK Government announced the Budget 2020. Since then, there have been some further decisions made in light of COVID-19.

We have rounded up all the changes you need to know about in the guide below.

If you would like a further breakdown of Budget 2020, please download our free guide here.

Key changes to tax, NICs and Pensions

Summary:

- Personal allowance increases.

- National Insurance (NI) threshold increases.

- Employment Allowance (EA) increases.

- Annual Exempt Amount for Capital Gains Tax increases.

- Flat-rate deduction for working from home increases.

- Domestic Reverse Charge for VAT introduced in October 2020.

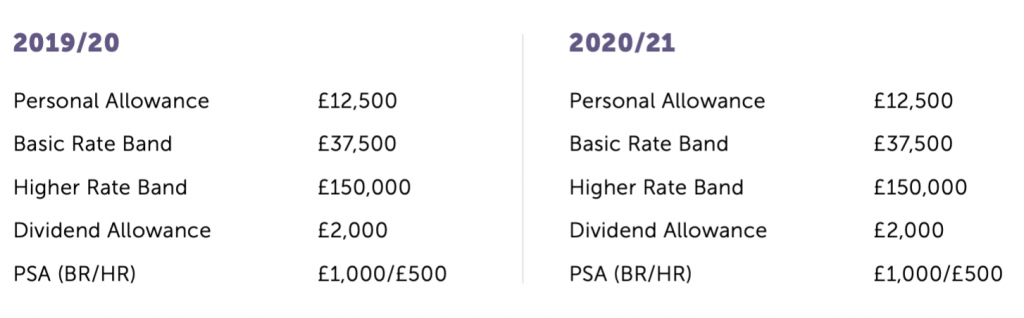

Income tax.

While not much has changed in terms of income tax, personal allowance has increased along with the National Insurance (NI) threshold.

There have also been some incremental increases to Married Couples Allowance and Blind Persons Allowance for 2020/21. However, the £5,000 0% Starter Savings Rate remains unchanged.

National Insurance.

The Primary Threshold and the Lower Profits limit sees an increase from £8,632 to £9,500.

The Secondary Threshold increases from £8,632 to £8,788.

Employment Allowance (EA) increases from £3,000 to £4,000 (for employers with a total qualifying employers NICs below £100,000).

From April 2021, employers of veterans receive a 12-month holiday from employer NICs for the first year of civilian employment. This is to encourage the hiring of former military employees.

Personal Tax.

Capital Gains Tax (CGT).

The Annual Exempt Amount increases from £12,000 to £12,300 for 2020/21.

Top Slicing Relief.

The government amends legislation to confirm how allowances and reliefs apply within the top-slicing relief calculation (in particular, the availability of the personal allowance) to ensure the relief is applied fairly.

Home office.

The flat-rate deduction for working from home increases from £4 to £6 per week.

VAT.

The Domestic Reverse Charge was originally announced in the October 2018 Budget, the charge was set to apply from 1 October 2019. The charge applies to certain building and construction services. Where the charge applies, the customer is liable to account to HMRC for the VAT on purchases, rather than the supplier.

The new rules were delayed from 1 October 2019 to 1 October 2020, due to lack of awareness of the charge, and with it coinciding with the (original) Brexit deadline.

The Chancellor has confirmed that the charge will come into effect this October 2020 as planned.

Pensions.

There will be an increase in the two tapered annual allowance thresholds:

- £111,000 to £200,000 (threshold income).

- £150,000 to £240,000 (adjusted income).

However, the minimum tapered annual allowance is to reduce from £10,000 to £4,000. The lifetime allowance is set to increase from £1,055,000 to £1,073,100.

There is to be a call for evidence on whether low earners (income under the personal allowance) should get basic rate top up on their pension contributions from the government (as they may not have paid any tax).

Unincorporated businesses.

Summary:

- IR35 policy changes have been delayed until April 2021.

- Business rates discount increased to 100% for all retail, leisure and hospitality.

- Up to £10,000 cash grants for those eligible for Small Business Rates Relief.

- Loan scheme with support loans of up to £5m with free interest for the first six months.

- HMRC helpline and online guidance for taxpayers with non PAYE income.

Business rates discount.

For properties with a rateable value below £51,000 in England would increase from 33% to 50% from 1 April 2020 (apply to cinemas and music venues).

Coronavirus update: Discount increased to 100% and extended to all retail, leisure and hospitality business for 2020/21.

Business rates support package.

Up to £25,000 grant funding is available for retail, hospitality and leisure businesses with a property with a rateable value of £15,000 to £51,000.

Meanwhile, there’s a £1,500 business rates discount for office space used by local newspapers in England, which will be extended for an additional five years until 31 March 2025.

For small businesses who already don’t pay business rates.

Any business that is currently eligible for the small business rates relief (SBRR) can apply for a £10,000 cash grant per business.

Similar grants of up to £25,000 will be available for larger businesses.

Coronavirus Business Interruption Loan Scheme.

More support for businesses to access bank lending and overdrafts has been offered via this scheme. Loans of up to £5 million in value to SMEs are now available with 0% interest for the first six months.

Extra support and guidance from HMRC and the UK Government.

HMRC is launching a dedicated COVID-19 helpline to help self-employed individuals and businesses agree a time to pay arrangement if they face difficulties paying their tax liabilities due to the virus.

HMRC is also scaling up its time to pay facility to help small businesses and the self-employed to defer tax payments over an agreed period of time.

Meanwhile, an online interactive guide for taxpayers with non PAYE income is to go live in the summer to help self-employed individuals better navigate the tax system.

Companies

Summary:

- Corporation tax remains at 19%.

- Consultation to take place on EMI Schemes.

- Structures and Buildings Allowance (SBA) to increase.

- Reform of Intangible Fixed Assets regime (IFA).

Corporation tax.

Corporate tax remains at 19% for financial years beginning 1 April 2020 and 1 April 2021, despite previous plans to reduce the rate.

EMI Schemes.

Consultation to be done to ensure the scheme provides support to recruit/obtain the best talent and examine whether more companies should be able to access the scheme.

Structures and Buildings Allowance (SBA).

SBA rate will increase from 2% to 3% (per year) from April 2020, allowing full tax write-off within 33 years rather than 50.

Intangibles reform.

Finance Bill 2020 amends the corporate Intangible Fixed Assets (IFA) regime.

From 1 July 2020, any intangible assets created before 1 April 2002 that are acquired from related parties can be brought within the IFA regime.

Note: An intangible asset is an asset that is not physical in nature. For example, goodwill, brand recognition and intellectual property like patents, trademarks and copyrights. In contrast, tangible assets include land, vehicles, equipment and inventory.

So, the tax relief for the cost of acquiring an intangible asset on or after 1 July 2020 is covered under a single regime, subject to some restrictions to prevent tax avoidance.

Employers

Summary:

- Employment allowance increases.

- Class 1 NIC threshold for employees increases.

- NIC holiday for veterans.

- Covid-19 Emergency Statutory Sick Pay measures.

- Benefits for zero-emission vehicles.

Employment allowance.

Employment allowance increases from £3,000 to £4,000 effective from 6 April 2020. Restrictions apply so that only employers whose NIC liability in the previous tax year was under £100,000 can access allowance.

Employer National Insurance Contributions.

Class 1 NIC threshold for employees increases. Changes have been made to the NI threshold for employers’ secondary class 1 NIC. This is £8,788 per year for 2020/21, previously (2019/20) this was £8,632.

NI contributions holiday for veterans.

Any employers of veterans in their first year of civilian employment benefit from a NI holiday exempting employers from any NIC liability on the veteran’s salary up to the Upper Earnings Limit. Employers can effectively claim this relief from April 2021.

Statutory Sick Pay (SSP).

As part of the emergency legislation outlined to tackle COVID-19, Statutory Sick Pay (SSP) is to be paid from the first day of absence, rather than the fourth day. Applies to those who have COVID-19 or have to self-isolate.

SSP is temporarily extended to cover:

- Individuals unable to work because of self-isolation.

- People caring for those in the same household who display COVID-19 symptoms.

Individuals who are not entitled to SSP (e.g. self-employed, employees with earnings below the Lower Earnings Limit) are encouraged to seek financial support through the welfare system. In particular, through the Employment and Support Allowance and Universal Credit.

Employee benefits and vehicles.

From April 2021, the benefit in kind (BIK) on zero-emission (electric) company vans will be £nil.

For vans with emissions, the flat rate BIK will be £666 from April 2020.

Moreover, car fuel benefit multiplier will be £24,500 from April 2020.

Capital allowances from April 2020/21:

- Zero emissions – Full First Year Allowances.

- Emissions up to 50g/km – 18% main rate WDA.

- Emissions 51g/km+ 6% special rate WDA.

Off-payroll/IR35 from April 2021.

This was originally introduced in April 2000 to prevent individuals/contractors from providing employment services to clients through an intermediary (e.g. limited company or partnership).

Since 6 April 2017, public sector employers, agencies and third parties have been responsible for determining whether their workers fall within IR35; the end client has the responsibility of making the relevant deductions of income tax and NI in respect of the worker’s pay and paying this to HMRC (rather than the intermediary).

The government initially announced in the Budget 2020 that from April 2020, the same IR35 rules extended to private sector contractors, thereby bringing them in line with the public sector (except for “small” organisations). The new rules have now been delayed to April 2021.

Entrepreneurs

Summary:

- The lifetime limit for Entrepreneurs’ Relief is reduced.

- Capital Gains Tax and the annual Exempt Amount is to increase.

Entrepreneurs’ Relief (ER).

In the 2018 Budget, the government increased the holding period for ER from one to two years. There was also required rights to income and capital (as well as voting rights) on share disposals.

From 11 March 2020, the lifetime limit for Entrepreneurs’ Relief is reduced from £10m to £1m.

The new lifetime limit takes account of ER disposals made before 11 March 2020.

Rules apply to certain forestalling arrangements entered into 11 March 2020. The disposal will be subject to the £1m lifetime allowance unless it can be demonstrated that the contract was not entered into to obtain a tax advantage by reason for the timing rule at TCGA 1992, s 28. Also, where parties are connected, that any relevant disposals were undertaken for commercial purposes.

Furthermore, certain share exchanges between 6 April 2019 and 11 March 2020, where both companies are substantially held by the same persons, it is possible to elect for ER to apply under TCGA 1992, s. 169Q. The new lifetime limit of £1m will apply to such cases.

Capital Gains Tax and the annual Exempt Amount is to increase from £12,000 to £12,300 for 2020/21.

Innovators

- Research and Development Expenditure Credit increases.

- Consultation on the R&D qualification on data and cloud computing.

Research and development (R&D).

Research and Development Expenditure Credit (RDEC) increases from 12% to 13% from 1 April 2020.

The (re)introduction of the PAYE cap on the payable tax credit in the SME R&D relief will be delayed until 1 April 2021.

There is also to be a consultation on whether expenditure on data and cloud computing should continue to qualify for R&D tax credits.

Landlords.

- Stamp duty surcharge.

- 30-day payment deadline for Capital Gains Tax.

30-day payment deadline for Capital Gains Tax.

From 6 April 2020, UK residents who dispose of a UK residential property must report the disposal and pay any associated Capital Gains Tax to HMRC within 30 days of completion.

A targeted market value rule was introduced for Stamp Duty and Stamp Duty Reserve Tax (SDRT) in the Finance Act 2018-19 on share acquisitions, when listed shares are transferred to a connected company. This rule is to be extended to unlisted shares, in a bid to prevent tax avoidance.

From 1 April 2020/21, there will be a 2% SDLT surcharge on non-UK residents purchasing residential property in England and Northern Ireland.

Increase in HMRC Enquiries

To ensure tax compliance, HMRC will contact taxpayers where there is a risk of compliance failure and/or where it is believed they have additional tax to pay. There will also be targeted checks, which will arise from an analysis of a wide range of data and intelligence available to HMRC.

In recent times, we have seen an increase in HMRC checks concerning:

- Offshore income/assets that may be taxable in the UK.

- UK property rental income.

Most recently, HMRC has announced it will be contacting taxpayers who claimed tax relief by subscribing to Venture Capital Trust shares and claimed relief in 2015/16, as there are circumstances where the relief should be withdrawn. Letters are expected to go out in March 2020.

It is generally better for a taxpayer to voluntarily disclose when there has been a failure in tax compliance, as HMRC are likely to look more favourably on the taxpayers who are open and forthcoming and seek to correct their tax affairs.

If you/your client requires assistance in making a disclosure to HMRC, please contact a member of our team.

All photography: Jack Gray Photography